[Solo lingua inglese] In the laste three decades, macroeconomic modelling has been dominated by Dynamic Stochastic General Equilibrium (DSGE) mod els. However, dissatisfaction with these models has been growing since the mid-2000s. Four primary weaknesses have been identified in DSGE models: unrealistic assumptions, a limited range of considerations, poor data fit, and logical inconsistencies and empirical non sequitur in aggregate production functions.

els. However, dissatisfaction with these models has been growing since the mid-2000s. Four primary weaknesses have been identified in DSGE models: unrealistic assumptions, a limited range of considerations, poor data fit, and logical inconsistencies and empirical non sequitur in aggregate production functions.

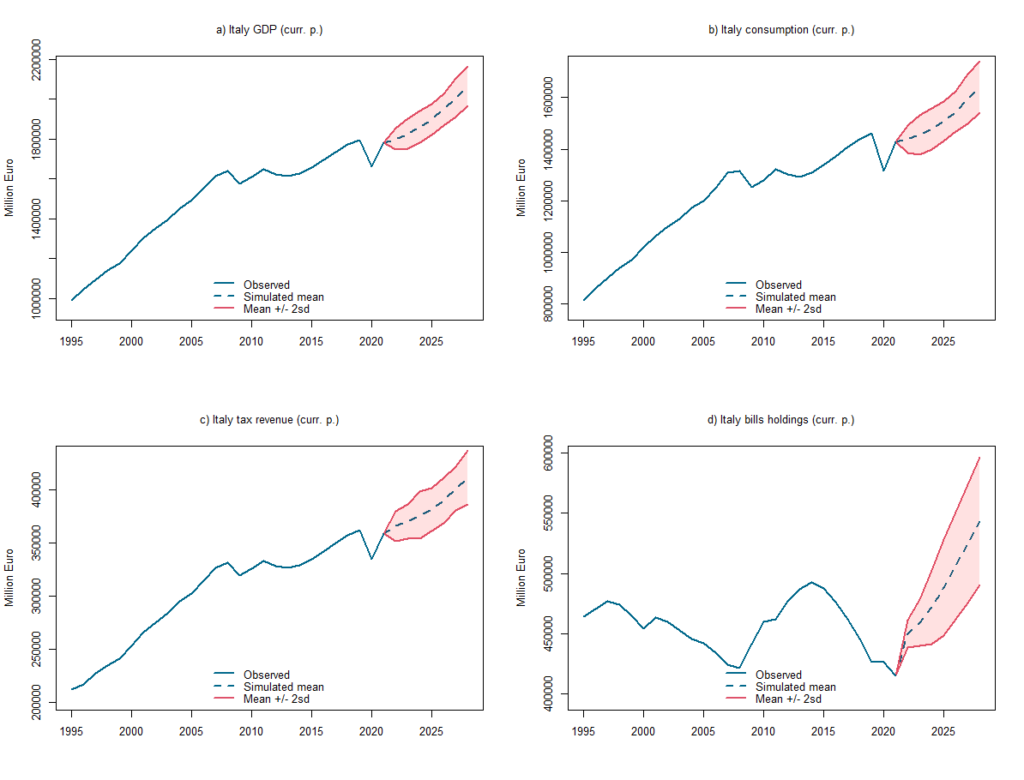

In response to these shortcomings, alternative models have emerged, aiming to address specific deficiencies. Computable General Equilibrium (CGE) models allow for broadening the scope but usually share key neoclassical assumptions with DSGE models. Leontief-like Input-Output (IO) models provide more room for a sound analysis of cross-industry interdependencies and the role of aggregate demand, but they still face limitations (as these models static in nature, and their coverage of financial aspects is usually quite limited). Heterogeneous agent-based models, network analysis, and other complexity models offer novel perspectives. Lastly, Stock-Flow Consistent (SFC) models have gained traction, finding applications in empirical macroeconomic research by institutions like the Bank of England and the Italian Ministry of Economy and Finance.

The resurgence of interest in SFC models can be traced back to Wynne Godley’s successful predictions of the U.S. crises in 2001 and 2007. Godley’s work laid the foundation for modern SFC modelling. These models, rooted in national accounts and flow of funds, integrate financial and real aspects of the economy, allowing for the identification of unsustainable processes.

[Keep reading and download the related codes from my GitHub repository]